Your cart is currently empty!

Tip: Include Lost Opportunity in the Total Cost of Training

There are manyfactors to consider when calculating the total cost of training. It is notenough to determine the development costs; one must also determine the deliverycosts to arrive at an accurate result. Most of us already know that. However,when calculating the total cost of training, we sometimes forget to include thecost of lost opportunity.

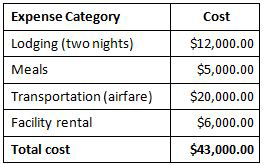

For example, let’sassume that we are bringing 40 sales reps together for a one-day workshop. Weneed to pay for food and lodging, transportation, and facilities rental.

It appears that our total cost for the workshop is $43,000.00. But whatabout the cost of lost opportunity? How does that affect the total cost for theworkshop?

What is lost opportunity?

For the purposes ofthis article, I define lost opportunity as the value of reduced productivity,or time lost, due to an individual’s absence from the job. Any time anindividual is not performing the tasks of their job, the organization incursthe cost of lost opportunity. This applies to time an individual spends intraining.

- When asales representative is in a training session, the sales rep is not selling.That represents a lost opportunity.

- When weutilize managers or other field employees to conduct a training session, theorganization also incurs the cost of the manager or field employee notperforming their regular job, another lost opportunity.

Calculating the cost

The cost of lostopportunity can have a significant impact on your organization. It may evenguide your decision-making process when comparing alternative training deliveryoptions.

There are a numberof methods available to calculate lost opportunity cost. Two popular methods,described below, are the labor cost methodand the value contribution method.

Compare the two methods.If these methods do not match your situation, you may need to do a littleresearch—you may need to get creative.

Remember, your goalis to quantify the value. You may want to consider working with your financeorganization to help you accurately calculate the cost.

The labor cost method

In situations wheretemporary personnel substitute for employees attending training, you cancalculate the lost-opportunity cost using daily salary information. This methodalso applies to situations where you may have employees work part of an extrashift to cover the time for another employee to attend training.

For this method, youneed to know the…

- Numberof temporary personnel hired to replace or fill-in for employees attendingtraining

- Daily salaryof the temporary replacement personnel

- Lengthof the class (in days)

After determiningthis information, you can calculate the lost-opportunity cost using the formula:

Number of temporary personnel x Daily salary xLength of class = Lost opportunity

When determiningthe length of the class, be sure to include any travel time required for the employeesto attend the training. For example, if employees spend one day traveling toclass, three days attending class, and one day returning, the total length ofthe class is five days. Do not forget to include the cost of any temporaryworkers who replace employees working as instructors.

For example

We need to pull 16individuals from a clean-room assembly line to train them on new workinstructions.

Number of temporary personnel = 16

Daily salary = $96.00 (based on an 8-hourshift at $12.00 per hour)

Length of class = 2days

16 x $96 x 2 = $3,072.00

Including inefficiencies

The formula usedabove assumes the temporary personnel operate at the same efficiency as theregular employees. To account for possible inefficiencies introduced by thetemporary personnel, you may want to include an inefficiency factor. Convertthe factor to a decimal value for use in the formula.

To do so, startwith the employee’s productivity level (100 percent) and combine it with theinefficiency level. In other words, to include a 20 percent reduction inefficiency, use 1.2 as the inefficiency factor (100 percent + 20 percent = 120percent, or 1.2).

To include a 50percent reduction, use 1.5 as the inefficiency factor (100 percent + 50 percent= 150 percent, or 1.5). When the inefficiency factor is included in thecalculation the formula becomes:

Number of temporary personnel x Daily salary xLength of class x Inefficiency factor = Lost opportunity

For example

In the examplebelow, we account for the inefficiency of the temporary employees. Thetemporary employees will only be 50 percent as efficient as the regularemployees, so our cost of Lost Opportunity is:

16 x $96 x 2 x 1.5 = $4,608.00

The value contribution method

Another method tocalculate the cost of lost opportunity is to use the amount of money eachemployee contributes to the organization’s gross revenue. To calculate the costusing this method, you need to know the…

- Gross revenueearned per employee

- Numberof annual productive days

- Numberof employees in training

- Lengthof the class (in days)

After determiningthe information listed above, you can calculate the lost-opportunity cost usingthe following formula:

(Gross revenue per employee/annual productive days)x Trainees x Length of class = Lost opportunity

To calculate grossrevenue per employee, you can divide annual net sales by the total number offull-time employees.

Annual net sales/total number of full-timeemployees = Gross revenue per employee

Annual productivedays are the number of days you expect an employee to work. To determine thenumber of annual productive days, you need to know the number of…

- Holidays

- Vacationdays

- Sick-leavedays

After determining thisinformation, you can calculate the number of annual productive days using thisformula:

261 – (Holidays + Vacation days + Sick leave days)= Annual productive days

You may wonderwhere the value 261 originates. There are 365 days in a year (we are going toignore the ¼ days and leap year). Subtracting 104 days to account for the 52weekends in a year leaves you with 261 potential workdays. Backing out theholidays, vacation days, and sick days, leaves you with the number of annual productivedays.

For example

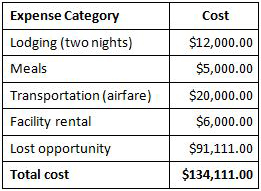

Let’s go back tothe example provided at the beginning of this article. We are bringing 40 salesreps in to participate in a one-day workshop.

- Gross revenueper employee = $250,000.00 (based on annual net sales of $50 million/200 full-timeemployees)

- Numberof participants = 43 (40 sales reps, two sales managers, and one meetingfacilitator)

- Annual productivedays = 236 (based on an 10 paid holidays and 15 days of PTO)

- Lengthof sales meeting = 2 days (based on a one-day meeting and one day of travel)

Our cost of lostopportunity is…

($250,000/236) x 43 x 2 = $91,110.70

Keep in mind that, in this example, we assume that allemployees contribute equally to gross revenue. You can modify the formulas toaccount for different levels of contribution.

When we include lost-opportunity cost, the total cost forthe workshop is significantly higher than $43,000.00.

Is this accurate?It may not be exact, but it provides a good picture of what it is reallycosting to remove 43 people from their normal job activities.

Note: Instead ofusing gross revenue you can also calculate the value contribution method using profitper employee…

Gross profit/total number of full-time employees =Profit per employee

and insert it intothe formula below.

(Profit per employee/annual productive days) x Lengthof class = Lost opportunity

You can modify any of these formulas to account fordifferent levels of employee contribution to gross revenue or gross profit.Work with your finance person to help you identify how.

Summary

Although oftenoverlooked, lost-opportunity cost is an important factor to consider whencalculating the total cost of training. Two methods for calculating the cost oflost opportunity are the labor-cost method and the value-contribution method.

Your financeorganization may be an excellent resource to help you with this type ofcalculation.