By early June 2020, as COVID-19 reached nearly every country around the globe, some US businesses were emerging from state-directed shutdowns while many office workers were still encouraged to work from home. Learning & development teams had settled into a temporary new normal and were feeling the effects of massive shifts in priorities and delivery for learning programs. The Learning Guild conducted a follow-up survey to its March 2020 research on the pandemic’s impacts to gather impressions on the current situation and the outlook for the future. While the second survey received fewer responses than the first (132 in June compared with 552 in March) results were consistent with the earlier findings.

Of note: the second survey was open from May 23 through June 9, 2020. George Floyd was killed May 29 and protests erupted across the US and worldwide in response to racism and police brutality. It is likely that response rate and the substance of responses themselves were affected in the second half of our survey dates, although there is no specific data to support this.

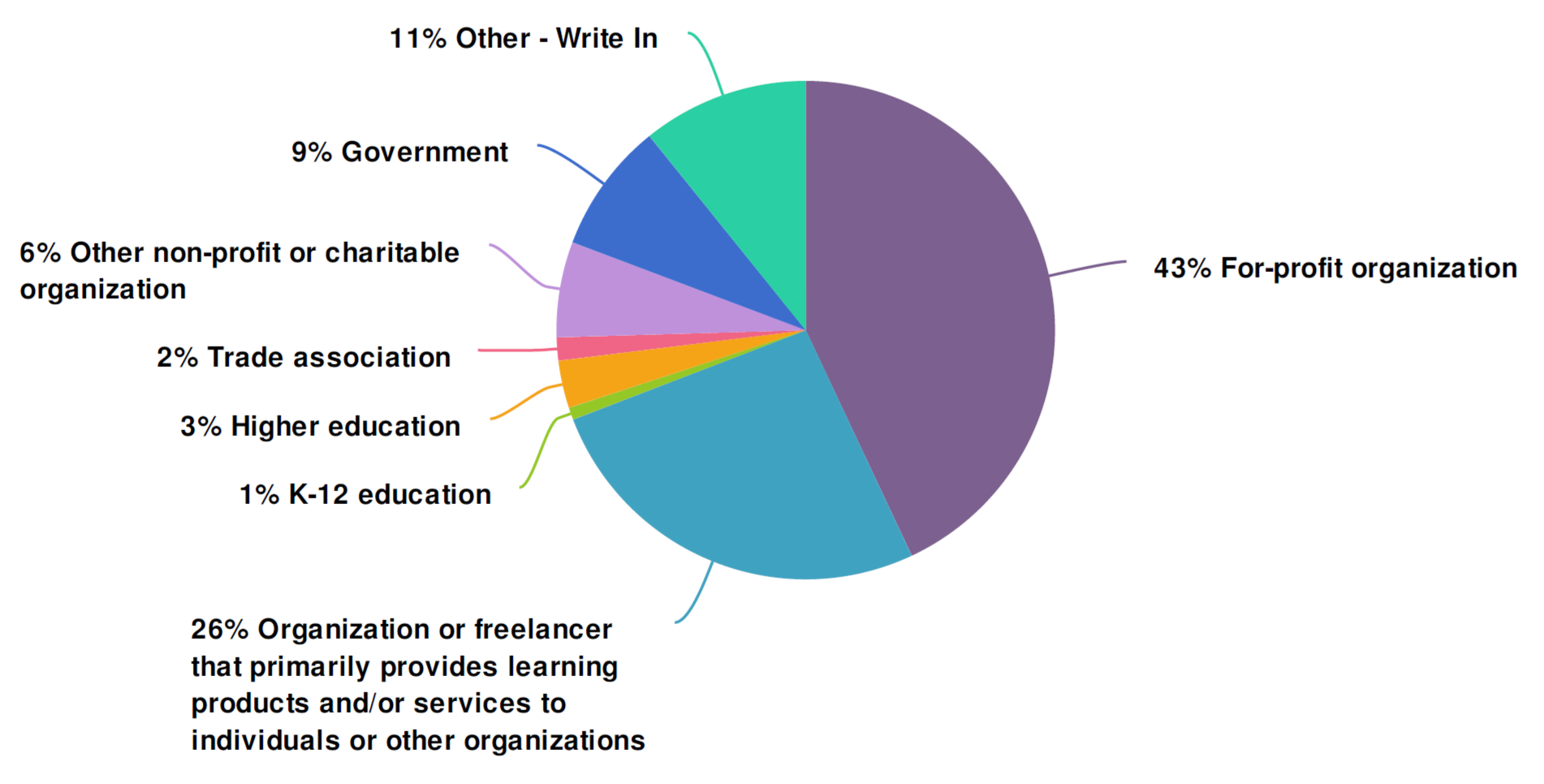

We asked two demographic questions about our survey population along fault lines we expected to reveal considerable differences in experience. The first question asked what type of organization the respondent worked for, allowing us to separate products & services providers to the L&D industry (vendors, including freelancers) from the organizations that purchase those solutions but whose primary line of business is not providing learning & development services. (Perhaps the easiest way to distinguish this is if you were attending a DevLearn Expo, we separated out the organizations who would have display booths from the ones doing the shopping.)

Fig. 1: Over one-quarter of respondents work for organizations that are providers of products or services to L&D organizations. n = 130

Fig. 1: Over one-quarter of respondents work for organizations that are providers of products or services to L&D organizations. n = 130

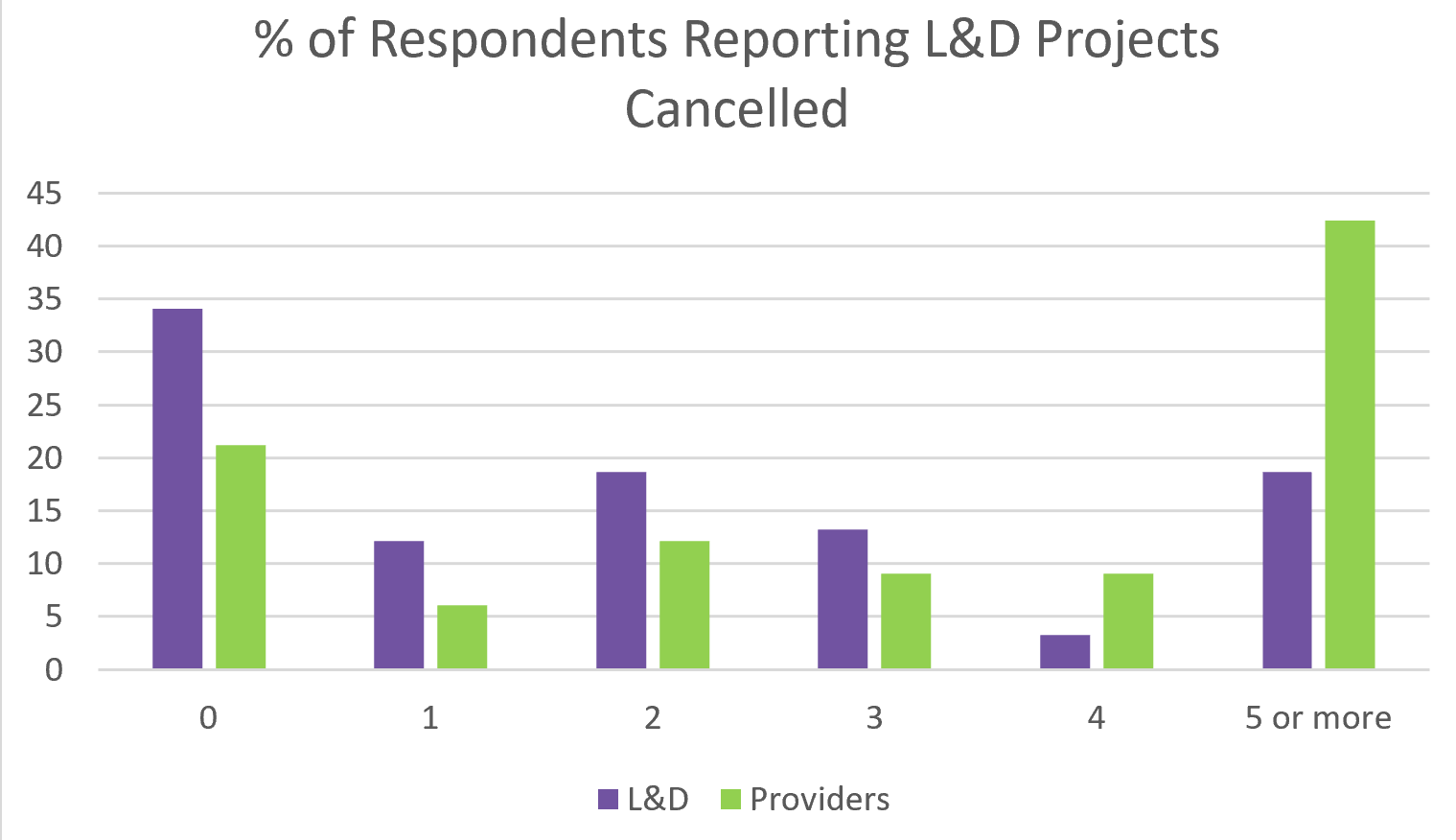

Providers were more likely to report a greater volume of cancelled L&D projects than the organizations they serve. On the other hand, some providers saw increased demand as clients rushed to convert existing instructor-led training to online formats.

Comments from the free-form section of the survey reflect this mixed impact on the providers:

“Clients remain reluctant to engage consulting jobs virtually unless trust was already built before the pandemic ensued.”

“Depending on our customers' business sector, we've had customers cancel projects (e.g., airline industry, entertainment industry) or add new projects (e.g., education, healthcare). However, collecting payment from most customers has become a problem.”

“My clients have largely responded by converting anything and everything to digital delivery and reducing headcount by eliminating contractors.”

Fig. 2: 42% of providers report losing more than 5 projects that had been scheduled to launch. n = 91 L&D organizations, n = 33 providers

Fig. 2: 42% of providers report losing more than 5 projects that had been scheduled to launch. n = 91 L&D organizations, n = 33 providers

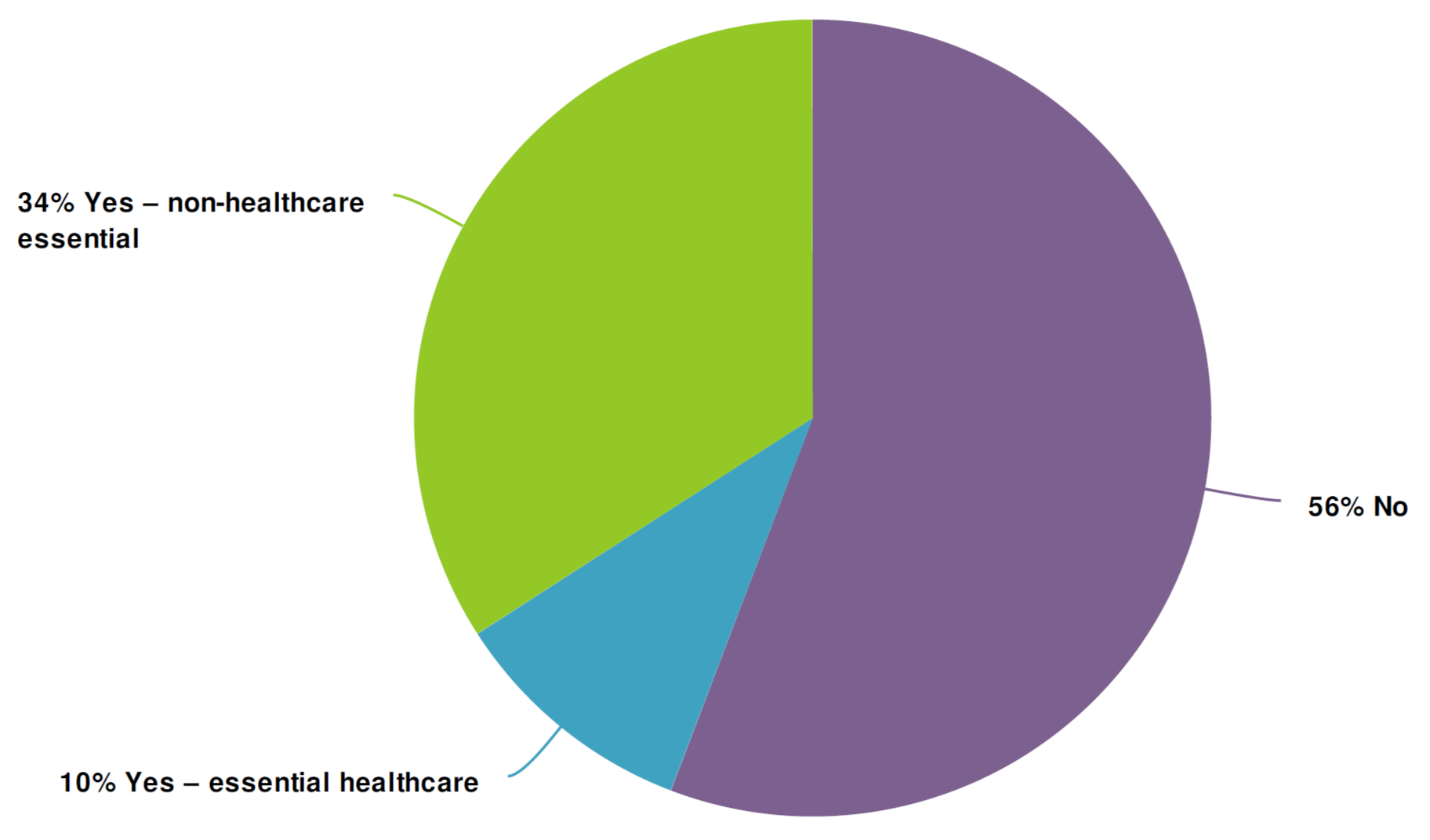

We expected to see considerable differences among our second key “demographic” question: “Is your organization’s primary activity considered “essential” in your local area?” Roughly a third of respondents (34%) work for non-healthcare essential businesses and another 10% work for essential healthcare businesses (all of which are in the US and Canada). Just over half of respondents (56%) work for organizations that are not considered “essential.” None of the L&D product & service provider organizations in our survey were considered essential. Surprisingly, we did not see material differences in responses to our survey questions across these three slices.

Fig. 3: 44% of respondents work for organizations whose primary activity is considered “essential”. n = 129

Fig. 3: 44% of respondents work for organizations whose primary activity is considered “essential”. n = 129

The virtual classroom is here to stay

As suggested in the March 2020 survey and borne out by the experience of many L&D practitioners, the pandemic is changing how training is delivered, and those changes are expected to persist into the future. In the June survey, we asked L&D professionals several questions about the nature of their work over five time periods:

- 2019: This was our pre-COVID-19 control period, back when life was “normal”.

- March - May 2020: This coincides with the stay-at-home orders in place in many countries, US states, and many large organizations. By the end of May, as states were opening up in phases, infection and death rates continue to climb in new hotspots.

- Second half of 2020: The remainder of this calendar year is forecasted to bring global recession and an anticipated second wave of infection. At the same time, many organizations are likely to increase their diversity, equity, and inclusion training.

- 2021: Optimistically, science will be catching up to the virus in 2021, bringing an effective treatment and/or a vaccine. Continuing waves of shutdowns will likely be needed to combat localized outbreaks.

- 2022: Many cultural and educational institutions are forecasting 2022 as the first opportunity to “return to normal” which will, most likely, look quite different from 2019’s version of “normal”.

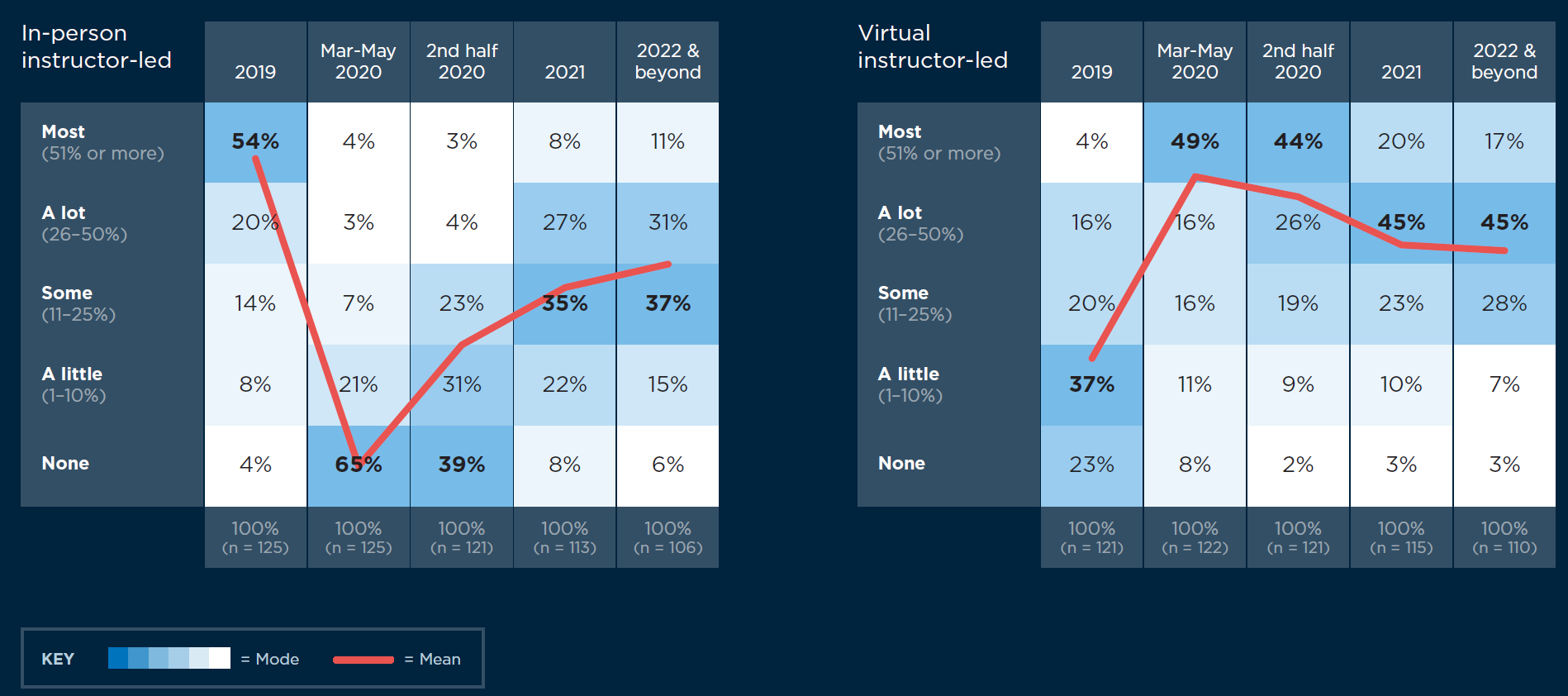

The most dramatic—and utterly unsurprising—shift is from a reliance on in-person, instructor-led delivery to virtual classroom. Prior to the pandemic, 54% of respondents said their organizations delivered more than half their training in a face-to-face format, compared to only 4% reporting a similar reliance on virtual classroom training. 23% of organizations offered no virtual classroom training at all.

In the March - May 2020 period, things changed dramatically. Fully 65% of respondents said their organizations delivered no training at all in a face-to-face setting, and 49% reported delivering more than half their training using virtual classroom. By this period, only 8% of organization offered no virtual classroom training at all.

Respondents projected that the second half of 2020 would see some easing from this fast and extreme shift, but things won’t be the same again. Post-pandemic, L&D professionals expect to see a continued reliance on virtual classroom training, with 89% of respondents predicting that live classroom training will represent less than half of all training delivered, and 90% predicting using virtual classroom for 11% or more of training by 2022.

Fig. 4: Respondents moved quickly from a live classroom model to virtual classroom, and the changes are predicted to persist into the future

Fig. 4: Respondents moved quickly from a live classroom model to virtual classroom, and the changes are predicted to persist into the future

Insights from respondents shed light on this rapid shift:

“For a workplace that has been optimized almost exclusively towards face-to-face learning, facilitators have had to rapidly acquire and put into practice new skills for training content delivery, often with much reluctance on their part and very little support from senior management and stakeholders.”

“We continue to wonder when we are going to be able to bring back face-to-face classes. In addition, we used to run 4-5 speaker sessions a month with 100+ attendees and we anticipate that we may never be able to hold those sessions again. As we have started to move those sessions virtually there is a good chance they will stay that way.”

eLearning and performance support on the rise

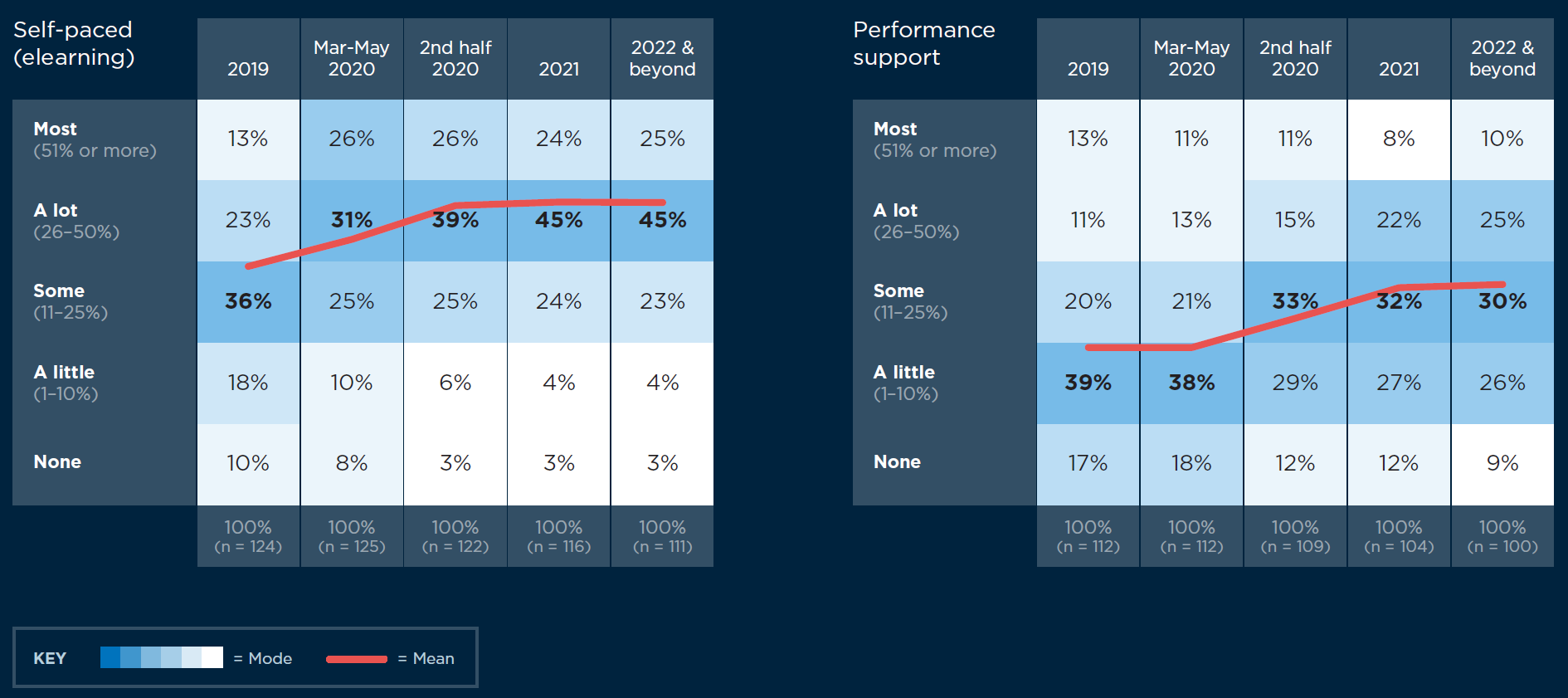

As organizations move beyond a reliance on face-to-face training, elearning and performance support are also expected to be on the rise in the future, although to a somewhat less dramatic effect than virtual classroom training. The rapid uptick in the use of elearning in March - May is likely to be attributed to the use of pre-existing content rather than newly created resources, given the length of time required for development.

Fig. 5: eLearning and performance support solutions are predicted to increase in usage post-pandemic

Fig. 5: eLearning and performance support solutions are predicted to increase in usage post-pandemic

Respondents expressed a variety of opinions on the shift to more digital means of working and delivering training:

“Many leaders who were non-believers of working virtually have changed their tune. Most have embraced it, and there are a few who are still looking forward to being back in the office part-time.”

“COVID-19 is like digital transformation on LSD... hyped up and with unrealistic expectations that eLearning is developed by the click of a button.”

“We are one year in to a major three-year initiative to replace systems, processes, and policies company wide. Training has to continue, just using alternate delivery methods.”

Looking ahead: L&D teams are optimistic about post-pandemic prominence

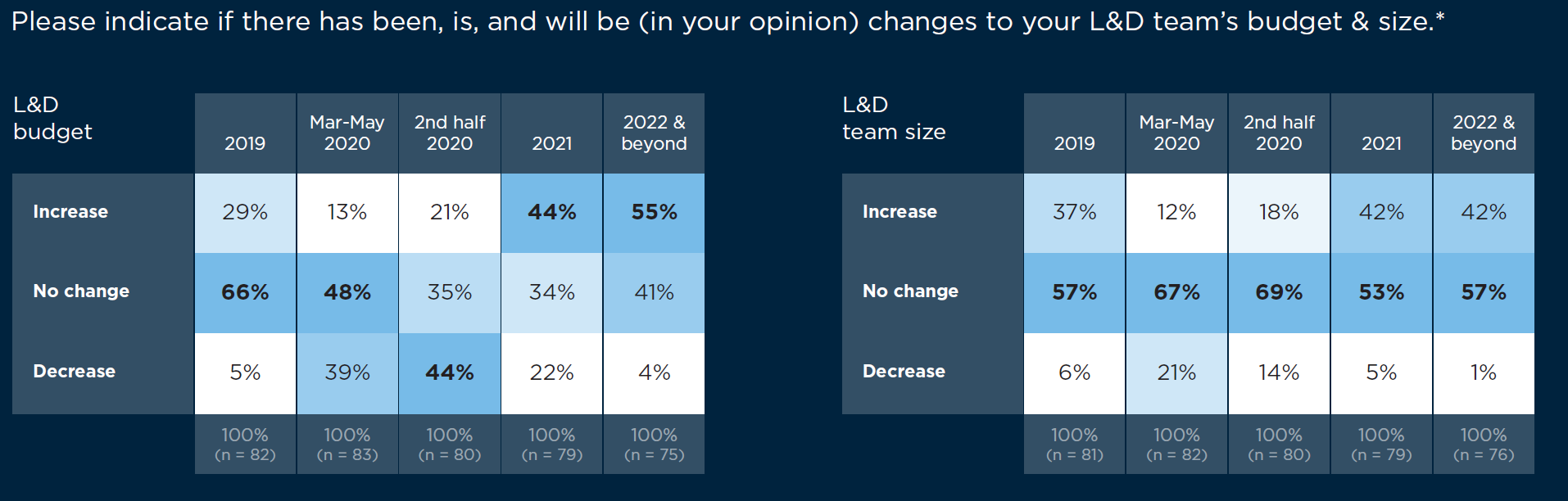

We asked the respondents who were not providers about their experience and their predictions for the budget and size of the L&D organization. During March - May, 39% saw decreasing budgets and 21% saw decreases in their team size as businesses took massive cuts due to the shut-down orders. Looking ahead to 2021, however, 44% of respondents are predicting an increase in L&D budgets and 42% predict an increase in headcount. By 2022, 55% expect to see increased budgets for L&D while only 4% expect to see a reduction. This points to considerable optimism about the importance of L&D, even in a period expected to be globally recessionary.

Fig. 6: L&D budgets and headcount are expected to rise beginning in 2021

Fig. 6: L&D budgets and headcount are expected to rise beginning in 2021

What’s next?

The results from this survey indicate that L&D professionals do not expect a return to the “normal” of 2019. As organizations have challenged their previously held beliefs about where and how work and training need to happen, the Learning Guild community will see corresponding shifts in the skills needed to meet these new demands.

Want more?

For more information on both COVID-19 surveys don’t miss The Learning Guild’s July research report, COVID-19 and L&D: Present and Future. Not a member? No problem! Sign up here.